9 changes to the 2024-25 FAFSA® adult students should know

Written by Elizabeth Exline

Reviewed by Bronson Ledbetter, MBA, Vice President, Student Services and Financial Operations

The Free Application for Federal Student Aid (FAFSA®) has undergone a makeover for the 2024-25 award year. Normally available in October, the new FAFSA form wasn’t unveiled until the end of 2023.

Designed to streamline the application process, improve accessibility and more accurately determine students’ need for aid, the new FAFSA form has fewer questions, updated calculations and new terms.

If you’ve wondered, “Why isn’t the FAFSA working?” or if you’ve simply waited until its release to begin the process of applying for loans, scholarships and grants (you may need the FAFSA for all of these), Chris Conway, the director of financial education initiatives at University of Phoenix, shares nine FAFSA changes adult students need to know about.

1. You contribute, I contribute … who contributes? The new FAFSA features a number of new terms to get familiar with. Chief among these is contributor.

A contributor is anyone required to provide information on a student’s form. For adults, this might extend to your spouse. Dependent students, by contrast, might request details from their parents. Contributors aren’t on the hook to pay for a student’s education, but they do need to provide financial information to help determine the student’s eligibility for aid. If a contributor doesn’t furnish this info, the student becomes ineligible for aid.

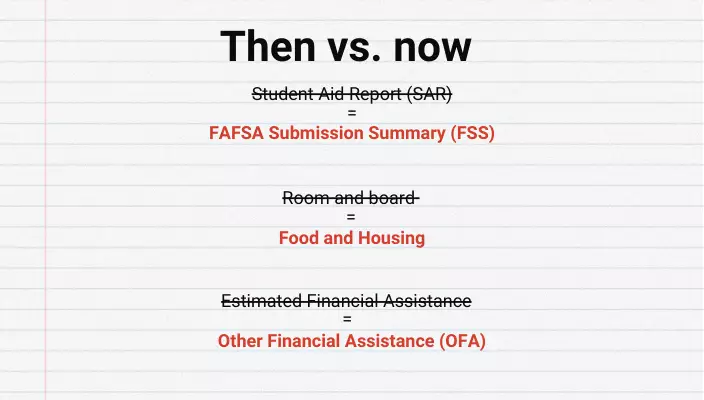

2. Language matters. Other new terms include FAFSA Submission Summary (FSS), which replaces Student Aid Report (SAR). Food and Housing replaces room and board as a factor in a student’s Cost of Attendance. Family size replaces household size. And Other Financial Assistance (OFA) is now used instead of Estimated Financial Assistance.

3. Leave it to the computers. Where contributors once entered their tax information manually or opted to use the IRS Data Retrieval Tool (DRT), all contributors must now use the FUTURE Act Direct Data Exchange (FA-DDX). The carrot is that this feature will be faster and more accurate. The stick is that if you don’t provide consent, your FAFSA will be rejected.

4. Say goodbye to the Expected Family Contribution (EFC). And say hello to the Student Aid Index (SAI). This new term reflects an updated formula designed to more accurately estimate your need for financial aid.

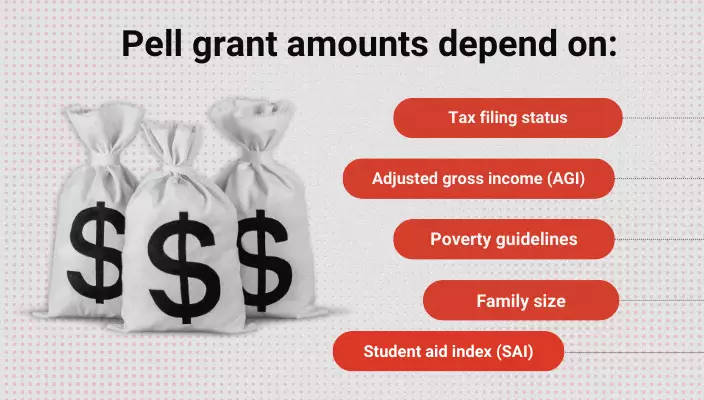

5. It’s all about the Pell. The amount of Pell grant you could receive can be based on whether you are required to file taxes, your adjusted gross income, federal poverty guidelines, family size and SAI. The school will determine your eligibility for a Pell grant and share it in your award letter.

6. Certain military accommodations have been updated. The Iraq and Afghanistan Service Grant and the Children of Fallen Heroes Awards have been replaced with new eligibility criteria. Eligible students will receive a maximum Pell grant, regardless of their SAI.

7. Family matters (but only up to a point). While you’ll still be asked how many family members are enrolled in college, the answer will not be factored into the SAI. (It used to be calculated in the EFC.) Pregnant students can no longer claim unborn children in their family size. Families include anyone who is eligible to be claimed on a tax return as defined by IRS regulations for exemptions.

8. Everything counts. The net worth of a family farm or small business with fewer than 100 employees is now factored into the FAFSA calculation. Child support, meanwhile, is considered an “asset” rather than “untaxed income.”

9. Dream big. You can now list up to 20 colleges you’re considering. The limit used to be 10.

ABOUT THE AUTHOR

Elizabeth Exline has been telling stories ever since she won a writing contest in third grade. She's covered design and architecture, travel, lifestyle content and a host of other topics for national, regional, local and brand publications. Additionally, she's worked in content development for Marriott International and manuscript development for a variety of authors.

This article has been vetted by University of Phoenix's editorial advisory committee.

Read more about our editorial process.

Read more articles like this: