Financial aid: University of Phoenix’s working student’s guide to paying for school

By Elizabeth Exline

You’ve decided to get your degree, but how will you pay for it? That’s a question facing many prospective students. It’s common knowledge that financial aid options are available for those who qualify for it, but what exactly are those options and how do you qualify? Here are some of the ways you can make paying for college a reality.

Start with a budget

Krystal Christopher, a senior finance advisor at University of Phoenix, knows firsthand about juggling work, life and college. She was a working mother when she completed her degree, and now she helps other people achieve their dreams.

Christopher recommends establishing a budget before you do anything else. Once you know what you can comfortably afford, you’ll know what you need in the way of financial aid, and you can begin exploring options. Leverage free online tools and calculators to help understand the full cost of college, Christopher says. The goal, after all, is to minimize debt as much as possible.

At University of Phoenix , financial aid begins with education. That’s why the University maintains various resources to help students understand the cost of its programs and the options to help fund it. For example, the University offers a free net price calculator

that estimates financial aid as well as courses and tools through iGrad

.

Wondering how you will pay for college? Learn more about federal financial aid here .

How to apply for federal financial aid

The FAFSA®

If you’re applying for federal financial aid, including grants and loans, you will need to submit a Free Application for Federal Student Aid (FAFSA®) form. This is an application that will be your starting point for seeking federal financial aid.

Make sure you fill it out completely with tax information and the colleges you’re applying to. June 30 is the deadline to submit the FAFSA form for each school year. Some universities, like University of Phoenix, operate year-round, and will work with you to ensure you submit the FAFSA form for the right academic year.

Pro tip: Make sure you select the correct program you need tuition support for. If you’re applying for a bachelor’s degree, for example, don’t select a graduate program. That would automatically eliminate you from receiving a grant.

You don’t have to commit to anything right away, but you can see what you may qualify for in terms of grants, a federally subsidized loan or an unsubsidized loan. You can use that information to better budget for college and see your out-of-pocket expenses.

Grants, college scholarships and tuition reimbursement

Grants

You should receive an email listing what you’re eligible for, in terms of federal grant money and federal loans, just a few days after filling out a FAFSA form. The maximum Federal Pell Grant award is $6,495 for the 2021-22 award year.

While you typically don’t have to pay back federal grants, there are eligibility requirements that you must meet to receive a grant.

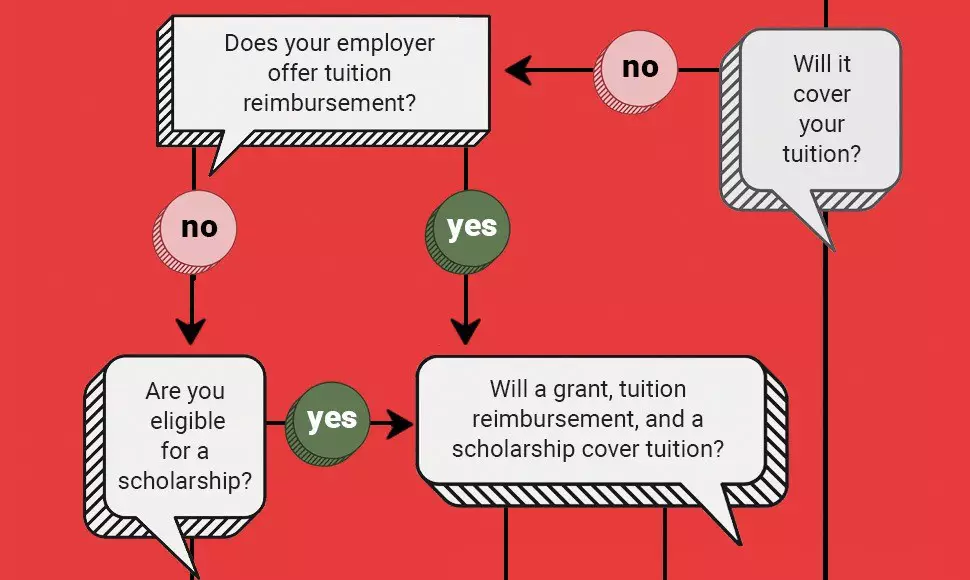

Tuition reimbursement and employer benefits

The next step after receiving your federal grant estimate should be a discussion with your employer’s HR office. Many employers offer a tuition reimbursement plan that could pay for some or all of your tuition. This is another way to reduce your out-of-pocket costs.

Christopher recommends asking your employer about any opportunities they might have to help you pay down your student loans. Employers need qualified talent, and these plans are a great way to find and retain valuable employees. Even if your employer doesn’t currently offer a tuition reimbursement plan, Christopher recommends asking them to consider one.

Scholarships

After exploring federal grants and tuition reimbursement plans, you should apply to scholarships offered by the colleges you’ve identified. Talk to their financial aid advisors to identify any scholarships offered by the universities that could help pay for college.

In addition to scholarships offered by your preferred college(s), consider applying for scholarships outside those offered by schools. And don’t be intimidated by the scholarship process, either. Staying organized and paying attention to details is half of the application experience. And remember: Putting in the effort to research and apply for multiple scholarships can pay off in more free money for college.

Ready to enroll? Learn when you should apply for financial aid at University of Phoenix.

Other benefits

After exploring scholarships, you should also see if you’re eligible for other benefits. For example, there are military benefits, Native American benefits and tribal grants.

There are other options are available as well. Alternative credits

can be a convenient way to expedite your degree and lower the cost of the overall program. Additionally, Prior Learning Assessments

can translate previous experience in work or life into college credit.

Pro tip: Explore all opportunities to cover college tuition before looking at loan options. Beyond grants, scholarships and tuition reimbursement, identify savings that could be used to help pay for college. Double check to see if you have a 529 out in your name. You might also be able to set up a payment plan where you pay a small monthly amount toward your tuition.

Loans

If you still need funding to cover college, you may want to consider a federal loan. This could be used to help cover college tuition and expenses, like purchasing a laptop. You will have to start paying back the loan, with interest, six months after you stop attending school.

Remember the FAFSA? That same form will also include eligible federal loan amounts. There are three types of federal loans: subsidized, unsubsidized and PLUS loans.

- Subsidized Stafford Loans are income-based and feature the same interest rate as the unsubsidized loans for undergraduate programs. For subsidized loans, the federal government covers the accruing interest while a student is attending school.

- Unsubsidized Stafford Loans are similar to Subsidized Stafford Loans

, however difference is that interest isn't being covered by anyone just accruing month to month.

- Both are at 3.73 percent as of February 2021. Repayment terms are the same for both subsidized and unsubsidized. For both subsidized and unsubsidized loans, payment isn’t required until 6 months after graduation or 6 months after dropping below half-time enrollment status.

- PLUS loans are available for graduate students and parents of dependent undergraduate students at a higher interest rate (6.28% as of July 2021-2022) than an unsubsidized loan. There are Graduate Plus and Parent Plus loans (for dependent students) and both require a credit check.

Pro Tip: Choose a loan option that works for you but remember to borrow responsibly. By limiting the amount of loan money you accept to what is necessary, you will reduce your repayment burden down the road.

If you can, Christopher suggests making monthly interest payments on unsubsidized student loans while attending college. You can factor this into your monthly budget using a free college-planning tool. Consider it an expense like a cable bill or groceries.

Paying the interest that accrues on your loans during college means paying less after college. It also helps you get into the habit of paying your student loans.