What is a 529 plan and how does it work?

Written by Elizabeth Exline

Reviewed by Chris Conway, Director of Financial Education Initiatives and Repayment Management

What does a 529 plan do?

Formally known as a qualified tuition program (QTP), the 529 plan gets its nickname from Section 529 of the Internal Revenue Code, which authorizes them.

529 plans are essentially state-sponsored college savings plans that can apply to both out-of-state and home-state colleges. The account owner or saver is the person investing the money. The beneficiary is the person who will use the education savings account and its earnings for education costs. The beneficiary can be a child, a grandchild or even the saver.

529 plans are also “tax-advantaged,” which means the earnings in a 529 plan are exempt from federal income tax and most state income tax when applied to qualifying education expenses. (More on that in a minute.) All 50 states and the District of Columbia sponsor 529 savings plans, with many states offering tax benefits for contributing to a 529 plan.

There are two types of 529 plans: prepaid tuition plans and education savings plans. Each offers its own advantages, depending on your goals.

Prepaid tuition plans

Do you know exactly where you or your beneficiary will attend college? Do you wish you could lock in today’s rate for tomorrow’s degree? If so, a financial advisor might recommend a a prepaid tuition plan.

This plan allows the account owner to purchase units or credits at a participating college (usually public and in-state) at current prices. Those credits can then be applied to future tuition and mandatory fees and other benefits.

There are a few caveats, of course. For starters, if the beneficiary decides not to attend the college in question or another participating institution, they can withdraw the money but may face tax consequences as a result.

Prepaid tuition plans may also be subject to residency requirements, meaning the saver may have to reside in the same state as the university the beneficiary plans to attend.

Also, the federal government doesn’t guarantee the plans, although some state governments do. As a result, a certain level of risk is involved: You may lose some or all of your money if the plan’s sponsor has, as the U.S. Securities and Exchange Commission puts it, a financial shortfall.

Prepaid tuition plans are great if you have your sights set on a particular higher educational institution as well as a target date set at least a few years into the future to allow your investment to grow. They’re less great if you plan to use the money for non-qualified expenses like room and board or K-12 education, none of which are eligible expenses for prepaid tuition plans.

Education savings plans

Education savings plans offer a slightly more flexible option to prepaid tuition plans. A saver can invest in a variety of portfolios, including mutual-fund and exchange-traded fund portfolios and a principal-protected bank product. Savers can also invest in an age-based portfolio that shifts toward more conservative investments as the beneficiary grows closer to the age when he or she will need to withdraw funds. The investment options, in other words, are considerable.

Residency requirements are rarely in place for education savings plans, and earnings from the account are tax-deferred and can be applied to tuition, mandatory fees and room and board. Other qualifying expenses may include supplies like computers, books and software.

Withdrawals from education savings plans can generally be used at any college or university, not just the participating institutions of prepaid tuition plans, and up to $10,000 per year, per beneficiary can also be applied to tuition at K-12 schools.

While education savings plans offer more flexibility, they are not guaranteed by state or federal governments. (Principal-protected bank products, however, might be insured by the FDIC.)

The fine print

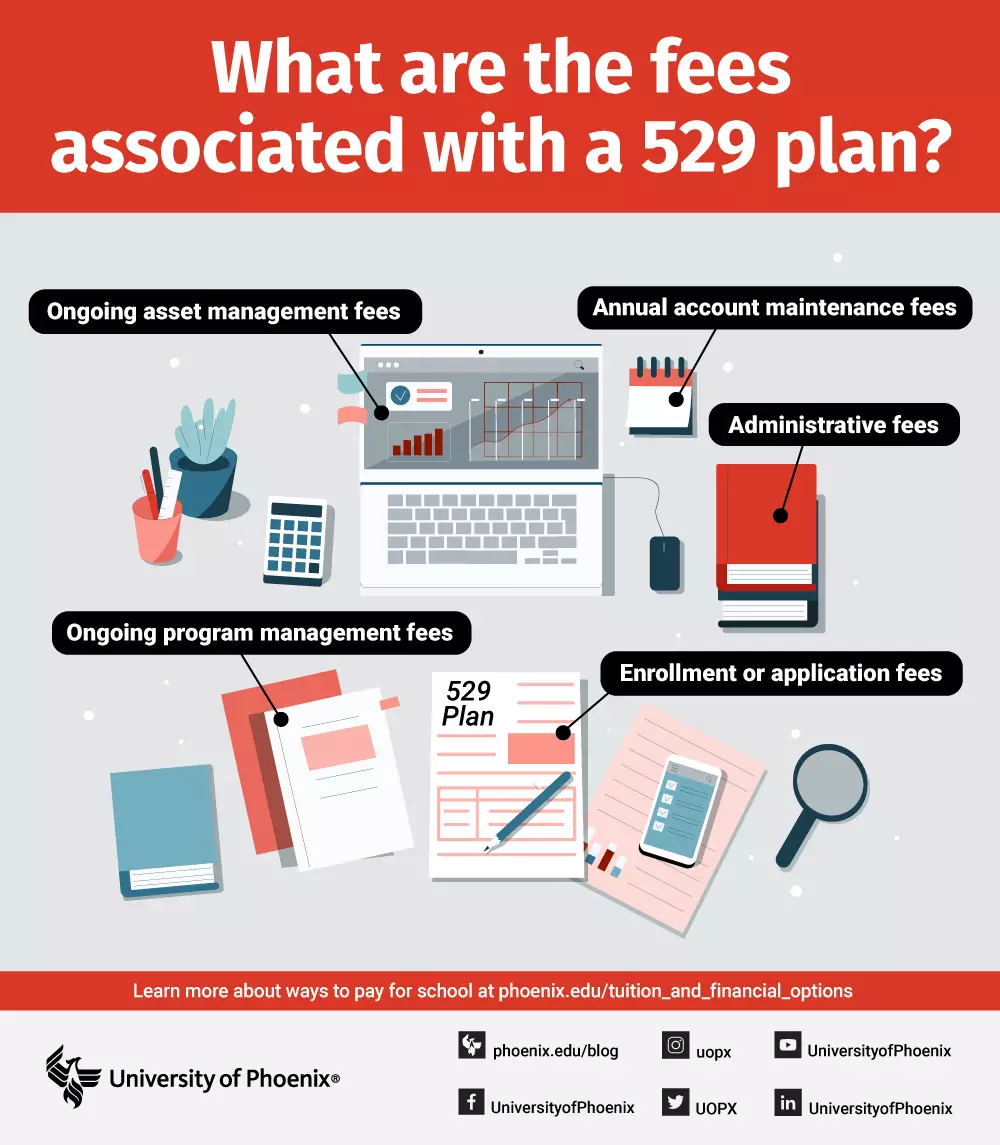

As with a Roth IRA or other investment option, 529 plans are subject to fees, which can lower your return. Such fees may include:

- Enrollment or application fees

- Administrative fees

- Annual account maintenance fees (education savings plans only)

- Ongoing program management fees (education savings plans only)

- Ongoing asset management fees (education savings plans only)

To avoid some of these fees, a saver may opt for an education savings plan provided directly by a state rather than through a broker.

Alternatively, some education savings plans waive or reduce fees when the account balance stays at or above a certain threshold, or when the saver sets up automatic contributions to the plan.

Are 529 plans only for college?

529 plans were initially earmarked exclusively for post-secondary education expenses, but no more! Since 2017, the plans have been available for use for K-12 education and, since 2019, apprenticeship programs. In fact, 529 plans can be applied to:

- Higher education at a college or university, including non-U.S. institutions

- Associate degree programs

- Graduate school

- K-12 education at a public, private or religious school

- Vocational and trade schools

- Student loans (up to $10,000 per beneficiary)

As account holders, savers can switch beneficiaries to a sibling or other family member (or even to him or herself!), although these changes are usually only permissible once a year. So, if the beneficiary doesn’t use all the money or decides not to use any of it, the plan can essentially be transferred to someone who will. And if a beneficiary receives a full scholarship, the saver can withdraw all the cash without incurring the federal income tax and 10% penalty normally incurred when the funds are used for anything outside of the qualifying expenses.

Is a 529 plan worth it?

Are you planning to pay for school for yourself or someone else at some point?

Do you like free money for school?

Do you like tax deductions?

If you answered yes to any of the above, then yes, a 529 plan is worth it.

As you explore 529 plans, keep the following in mind:

The more time you have to let the funds grow, the more money you’ll have for your tuition plan. So, start saving early!

Most states allow for immediate withdrawals on 529 plans. That means even if you set up the account one day and take out money the next, you’ll still qualify for a state tax deduction that year.

As with any financial investment, research equals rewards. There are always risk-based considerations and exceptions, so talk to a professional and seek out information to understand the specifics of your situation and state.

In the end, 529 plans are one more resource in your pay-for-college toolkit. And that means saving for college can be an attainable goal after all.

This article is intended solely to provide information and should not be considered financial advice. Before making any financial investments, you should consult a plan sponsor or financial or tax advisor for guidance on the best course of action for your specific needs.

Wondering how other people have paid for college and saved ? Check out the stories of four University of Phoenix alumni!

ABOUT THE AUTHOR

Elizabeth Exline has been telling stories ever since she won a writing contest in third grade. She's covered design and architecture, travel, lifestyle content and a host of other topics for national, regional, local and brand publications. Additionally, she's worked in content development for Marriott International and manuscript development for a variety of authors.

This article has been vetted by University of Phoenix's editorial advisory committee.

Read more about our editorial process.

Read more articles like this: