How to borrow student loans wisely

Written by Cassidy Horton

Reviewed by Chris Conway, Director of Financial Education Initiatives and Repayment Management

Financial literacy for college students

When it comes to financing your education, taking out student loans might be necessary. It’s essential, however, for students to understand the principles of financial literacy so they can borrow with caution to avoid taking on more debt than they can handle. This knowledge not only informs money management and personal finance but it also can better set you up to cover education costs while planning for a successful financial future.

Here, Christine Conway, the director of financial education initiatives at University of Phoenix, outlines five key tenets of responsible borrowing that every college student should follow.

1. Borrow only what you need

Borrowing more money than you need can lead to a heavy financial burden after graduation, as you’ll have to pay back the principal plus interest. This can limit your ability to pursue other personal finance goals, such as buying a home or starting a business.

According to Bankrate’s online calculator , every $1,000 you borrow equates roughly to $10 to $11 in monthly payments, Conway says. (For federal Direct Loans first disbursed on or after July 1, 2023, and before July 1, 2024, undergraduate loans come with a 5.5% interest rate, while graduate loans have a 7.05% interest rate, hence the variation.) Using these guidelines, a $20,000 undergraduate loan could end up costing $200 per month or more for 11 years.

Additionally, taking out more loans than necessary can play a role in future money management by affecting your ability to get approved for future loans. Lenders look at your debt-to-income ratio, which is the amount of debt you have compared to your income. If you have too much debt, your credit score may suffer, and you may be seen as a high-risk borrower.

2. Know what you’re going to borrow this year

Knowing exactly how much you’ll need to borrow for the academic year is crucial to responsible borrowing. The cost of attendance can vary from year to year, so it’s important to regularly reevaluate your borrowing needs and adjust accordingly.

To get a clear idea of the total cost of attendance for the upcoming academic year, look at your school’s financial aid award letter. The letter outlines the costs of tuition, fees, room and board, and other expenses for the year. Use this information to determine how much you’ll need to borrow.

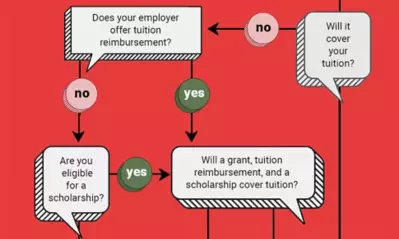

Be sure to explore all your options for non-loan funding, such as scholarships, grants and personal savings. Non-loan funding can help you pay for school without taking on additional debt.

Also, understand the differences between types of loans, such as subsidized and unsubsidized federal loans , as well as private loans.

- Subsidized loans do not accrue interest while you’re in school, whereas unsubsidized loans do.

- Private loans typically have higher interest rates and fewer repayment options than federal loans, so exhaust your federal options before turning to private lenders.

3. Know what you’re going to borrow for your entire program

It’s not enough to know how much you need to borrow for the upcoming academic year. You should also anticipate how much you’ll need to borrow for your entire program, including tuition, fees, books, supplies and personal expenses.

To estimate the total cost of your program, you can use online calculators, like the U.S. Department of Education’s Net Price Calculator or the cost projector calculator from Finaid

. The estimate should take into account inflation rates and other factors that affect the cost of attendance over time. You can also consult with your school’s financial aid office to get a more accurate estimate.

Luckily, most college students pay less than full price for college because of grants and scholarships. So, as you estimate costs for your entire program, “focus on net price, not sticker price ,” as BigFuture.com puts it. Once you have an estimate, you can begin to plan how you’ll finance your education.

4. Understand your future monthly payment

Understanding your future monthly payment is crucial to your finances because it allows you to plan for future expenses. It also ensures you’re able to make your payments on time.

The amount of your monthly payment will depend on several factors, including the amount you borrow, the interest rate on your loan and the repayment term. Generally, the longer your repayment term, the lower your monthly payment will be, but the more interest you’ll pay over the life of the loan.

One way to estimate your future monthly payment is to use an online loan repayment calculator. StudentAid.gov’s loan simulator lets you compare repayment options to find the best strategy for you. Simply enter the amount you plan to borrow, the interest rate and the repayment term, and the calculator produces an estimated monthly payment.

If you find that your estimated loan payment is higher than you can comfortably afford, there are a few things you can do:

- Consider alternative repayment plans. For example, an income-driven repayment adjusts your monthly payment based on your income and family size.

- Make additional payments while you’re in school. Even small payments can help reduce the total amount you owe and ultimately lower your monthly payment after graduation.

- Look for more non-loan financial aid options. Believe it or not, there’s a good chance you qualify for a scholarship — even if you don’t have perfect test scores.

5. Know your rights and responsibilities

As a borrower, you have both rights and responsibilities. Here are some of the key ones:

Student loan rights

- Students have the right to receive information about their loan terms and conditions, including interest rates, fees and repayment options.

- Students have the right to know how much they’ll owe each month and the total amount they’ll have to repay over the life of the loan.

- Students have the right to receive a grace period before repaying their loans.

- Students have the right to make payments on their loans at any time without penalty.

- Students have the right to request deferment or forbearance if they are unable to make their loan payments.

Student loan responsibilities

- Students are responsible for repaying their loans, including interest and fees that may accrue.

- Students are responsible for notifying their loan servicer if there is a change in address, name or phone number.

- Students are responsible for making payments on time, even if they do not receive a bill or reminder.

- Students are responsible for completing entrance and exit counseling, which provides information about their loan obligations and repayment options.

- Students are responsible for understanding loan terms and conditions, including interest rates, fees and repayment options.

Bottom line

Understanding the principles of financial literacy is critical during your time as a student and can affect your life years after. Loans are a legal obligation for college students, and failing to repay them can have serious consequences. Therefore, it’s essential to only borrow what you need, to understand your rights and responsibilities and to take your loan obligations seriously. The less you borrow now, the less you’ll have to repay after school. A thoughtful borrowing plan can set you up for a successful financial future.

ABOUT THE AUTHOR

Cassidy Horton is an academic advisor turned finance writer who’s passionate about helping people find financial freedom. With an MBA and a bachelor’s in public relations, she’s had the pleasure of working with top finance brands like Forbes Advisor and PayPal. She’s also the founder of Money Hungry Freelancers, a platform dedicated to helping freelancers ditch their financial stress. In her spare time, you can find Horton hiking in the Pacific Northwest and cuddling her two cats.

ABOUT THE REVIEWER

As Director of Financial Education Initiatives and Repayment Management, Chris Conway works with departments across the University to provide resources that allow students to make more informed financial decisions. She is also an adjunct faculty member for the Everyday Finance and Economics course at the University, and she chairs the National Council of Higher Education Resources College Access and Success Committee. Conway is committed to helping college students make the right financial decisions that prevent future collection activity.

This article has been vetted by University of Phoenix's editorial advisory committee.

Read more about our editorial process.

Read more articles like this: