Understanding college tuition payment plans

Reviewed by Chris Conway, Director of Financial Education Initiatives and Repayment Management

Going back to college is a chance to improve your career opportunities, but figuring out how to pay tuition can be an obstacle for many. On the one hand, students may find their financial obligations prevent them from paying the tuition bill outright. On the other, the prospect of student loans and their interest-accruing debt can feel daunting.

Tuition payment plans, which allow you to make payments toward your tuition over several months, are an alternative. While this option is not available at all universities (or at University of Phoenix specifically), it can be helpful to know what’s out there. Keep reading to find out what a tuition payment plan is and how it could help you manage your college tuition bill.

What is a tuition payment plan?

A tuition payment plan breaks up your college tuition bill into equal payments across the semester or academic year. You might also see these called deferred payment plans or tuition installment plans.

Payment plans are short-term options, lasting from a few months to one year depending on what a given school offers. Some universities offer payment plans that cover the entire academic year. Other schools offer plans that break up the total cost into two or three payments.

Signing up for a tuition installment plan typically involves an enrollment fee that could be from $15 to $200. While it’s never fun to pay enrollment fees, they ultimately save you money: Enrolling in a payment plan means you’re not accruing interest as you would with a student loan.

How do tuition payment plans work?

Even when you’re awarded scholarships and grants, it might not be enough to cover your full tuition. Student loans are one option to close the gap, but the loans come with interest rates, possible credit checks and longer repayment terms. And if you borrow unsubsidized loans, the interest begins accruing right away.

Taking on loans also requires responsibility on the part of the borrower. It’s important to borrow only what you need, exhausting other free or low-cost opportunities such as scholarships and grants first.

When a tuition payment plan is available, however, that can be a good option to close the gap between your bill and your financial aid package. Here’s what to know before you enroll:

- Estimate your total cost of attendance

. This includes not just tuition but also related expenses like books and room and board.

- Run the numbers. Budget how much you can comfortably contribute to your tuition payments each month. Compare that with how much you’ll need for the year or semester.

- Enroll in your classes for the semester by the registration date. View the total cost and select the payment plan option when you get to the billing section.

- Be ready to make a down payment. Typically, you’ll need to pay a percentage of the tuition up front. Some colleges require an initial deposit of 20% to 50% of your total balance.

- Choose how you’d like to pay. Most payments are collected automatically from your bank account. You can also choose debit or credit card payment for an additional fee. Make your payments on time to avoid late fees.

Many universities have their own system for payment plans, but if your school doesn’t, you might be able to use a third-party service.

Tuition payment plan example

If you’re wondering how a payment plan functions, we’ll take a look at an example.

Let’s say you’re planning to attend a university full time next semester, and the total cost for the semester is $5,000. You’ve saved up about $1,000 to help with costs, but you know that won’t be enough. After filling out the FAFSA® form, you received a Pell Grant award of $1,600 for each semester. With this assistance, your total bill for the semester is now $3,400.

Instead of applying for a student loan, you decide on a five-month payment plan. The tuition payment plan charges a $30 service fee and requires a 25% ($850) down payment at sign-up. That $1,000 you have saved can be used to cover these costs.

Your $850 down payment is deducted from your total balance of $3,400. Your remaining balance of $2,550 is split into five equal monthly payments of $510.

Benefits of a tuition payment plan

Dividing the cost of education into more manageable monthly payments makes it easier for students to achieve their goals without accumulating debt.

That’s just one of the benefits of choosing a tuition payment plan. It also has these advantages:

- It doesn’t require a credit check.

- Typically, it doesn’t carry any interest.

- You get to choose which payment schedule works for you.

- Payments only last for a year at most.

- It might contribute to your eligibility for the American Opportunity Tax Credit

.

- You can set it and forget it with automated payments.

- Smaller payments are easier to budget for than one big, lump-sum payment.

Disadvantages of tuition payment plans

Before signing up for a payment plan, you should consider all sides of this decision. Are the monthly payments manageable for your family? If not, you could find yourself paying costly late fees.

You’ll also need to set aside money for the down payment that a tuition payment plan requires — and that could cost more if you enroll later.

You should also consider these drawbacks:

- Enrollment fees are usually required each semester and can cost between $15 and $200.

- Tuition payment plans don’t cover additional expenses like books or supplies.

- Some colleges don’t have long payment periods.

- You need to juggle earning income while going to school in order to cover your payments.

- Service fees may be involved for credit and debit card payments.

There are several advantages to choosing a monthly payment plan, but it’s important to consider how those stack up against your financial situation and obligations when compared to your other options.

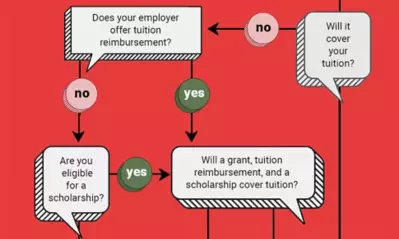

Other ways to pay for college

According to the student loan servicer Nelnet , only one in five students uses a payment plan to help fund higher education. So, what other options are available? Consider the following:

- Financial aid and grants

- Work-study programs

- Scholarships

- Employer tuition assistance

- Federal student loans

- Private student loans

Loans can be useful, but explore federal grants, scholarships and work-study programs first. While these might not cover everything, they can reduce the amount you have to take out in student loans, which accrue interest.

Lastly, you’ll want to evaluate your federal loan options before considering private student loans. That’s because federal student loans offer more protections and benefits than private student loans.

Overall, tuition payment plans can save you money on loan interest and they provide peace of mind in that you know you’re tackling your tuition in real time. But even with all the benefits of a monthly payment plan, you’ll still need to analyze your finances to know if this is the right move for you or if it’s even available at your school of choice.

University of Phoenix does not offer tuition payment plans, but it is committed to helping students save money with scholarships, generous transfer credit policies, alternative credit options, fixed tuition and more. Explore all the ways you can save !

ABOUT THE AUTHOR

Cassidy Horton is an academic advisor turned finance writer who’s passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, she's had the pleasure of working with top finance brands like Forbes Advisor and PayPal. She's also the founder of Money Hungry Freelancers, a platform dedicated to helping freelancers ditch their financial stress. In her spare time, you can find Cassidy hiking around the Pacific Northwest and cuddling her two cats.

ABOUT THE REVIEWER

As Director of Financial Education Initiatives and Repayment Management, Chris Conway works with departments across the University to provide resources that allow students to make more informed financial decisions. She is also an adjunct faculty member for the Everyday Finance and Economics course at the University, and she chairs the National Council of Higher Education Resources College Access and Success Committee. Conway is committed to helping college students make the right financial decisions that prevent future collection activity.

This article has been vetted by University of Phoenix's editorial advisory committee.

Read more about our editorial process.

Read more articles like this: